Image source: Getty Images

The steady returns and growth potential that dividend stocks offer make them highly attractive for a second income. Whether to supplement a salary or build towards a retirement fund, they’re a key part of most income investing portfolios.

Whenever the conversation turns to passive income ideas in the UK, the word dividends is usually not far off. They’re particularly popular at the moment as falling prices are pushing up yields. This means the FTSE 100 is awash with lucrative opportunities.

One of my top income-generating investments is Phoenix Group (LSE: PHNX), accounting for almost 25% of my dividend income this quarter.

Here, I’ll outline why I think it’s currently one of the best dividend stocks to consider for a second income.

Well-established demand

Operating in the life insurance and pensions sector, Phoenix is likely to bring in consistent revenue for the indefinite future. Its business model focuses on managing life funds and closed pension books, creating a predictable stream of income that supports dividends.

Created in 1857 as The Pearl Loan Company, the group is now the parent company of major British insurers Standard Life, SunLife, ReAssure and Ark Life. It employs 8,165 staff, serving customers across the UK, Ireland and Germany.

Dedication to shareholders

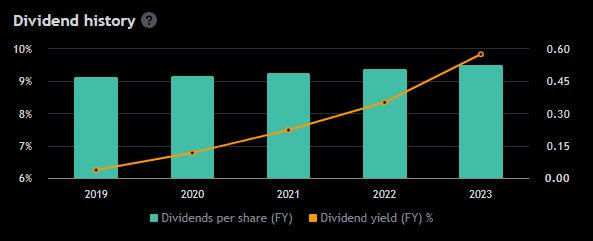

Phoenix prioritises returning surplus cash to shareholders through dividends. It’s been increasing its annual dividend for almost a decade, growing from 40.52p per share in 2015 to 52.65p today. Growing at an average rate of almost 3% a year, it’s likely to exceed 54p in 2025.

Recently, a slump in the share price has pushed the yield up to 10%, making it highly attractive. Not that it was ever low. Over the past 10 years, it’s hovered between 6% and 9%, well above the FTSE 100 average of 3.5%.

Risks to consider

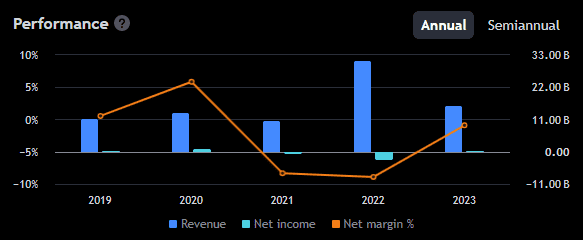

Lagging economic challenges following the pandemic suppressed growth and the group was unprofitable in 2021 and 2022. This contributed to a 32% share price decline over the past five years and prompted efforts to establish new avenues of growth.

The group subsequently racked up a lot of debt on its mission to grow through acquisition-led expansion. For now, the debt looks manageable but if it gets worse, it could limit the cash it has for day-to-day operations.

A rise in interest rates could spell trouble for the company, affecting both debt repayments and asset valuations. It could also put a strain on the company’s profits if rates drop too low. Considering the current uncertainty about where UK rates are headed, this is certainly a risk to be aware of.

A long-term outlook

When planning a strategy for income investing, it pays to think long-term. A bit of patience can lead to exponential gains down the road.

With the Phoenix share price now near its lowest level in 10 years, I expect bargain hunters will help ignite a recovery in 2025.

Either way, I plan to keep drip-feeding cash into the stock for years to come, with the aim of maximising my dividend income for retirement.